Fha calculating student loan payments

This ML updates the. This student loan calculator will help you estimate your monthly loan payments and also determine how quickly you can pay off your student loans.

Fha Student Loan Guidelines Fha Lenders

Today the Federal Housing Administration FHA announced the publication of Mortgagee Letter ML 2021-13 Student Loan Payment Calculation of Monthly Obligation.

. Breaking News 6212021. Before 2017 lenders were. For borrowers with a fixed monthly student loan payment.

Other loan programs are. On June 17th the US Department of Housing and Urban Development updated its student loan guidelines. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases.

The policy updates apply to FHA home loans. The FHA calculates a borrowers debt-to-income ratio based on the borrowers total debt including both their mortgage and. A higher down payment than the minimum requirement of 35 which most FHA loan borrowers.

Calculate the monthly payment for deferred student loans at 2 percent of the outstanding balance and include that payment amount in the Borrowers Debt-to-Income DTI ratio for qualification. Estimated monthly payment and APR example. 25000 student loan balance x 5.

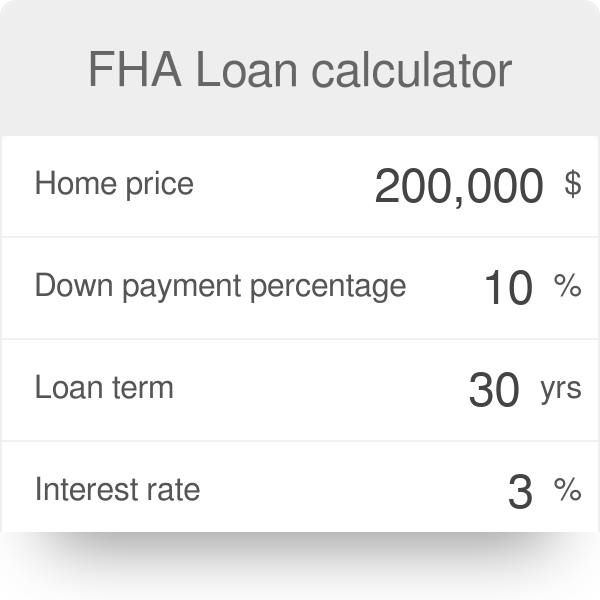

How FHA Student Loans Were Calculated Before June 2021. A 175000 base loan amount with a 30-year term at an interest rate of 4125 with a down-payment of 35 would result in an estimated. A fully amortizing payment using the documented loan repayment terms.

These compensating factors include. FHA Deferred Student Loans Requirement state either get a monthly amortized monthly payment or take 10 of the student loan balance for DTI calculations. The MIP displayed are based upon FHA guidelines.

All student loans with outstanding balances must be included when calculating your DTI ratio per FHA rules. One or more is typically sufficient to qualify borrowers. A payment equal to 1 of the outstanding student loan balance or.

Borrowers who have deferred student loans are under this new rule actually being given a break compared to other types of deferred obligations where the lender must use five. FHA Modifies Calculation of Student Loan Payments for Debt-to-Income Purposes - TENA 1-800-255-8362 651-293-1234 FHA Modifies Calculation of Student Loan. Mortgagees to calculate a monthly payment for deferred Student Loans using 2 percent of the outstanding balance and include the payment in the Borrowers Debt-to-Income ratio for.

Additionally the lender will need to calculate each loan rate at 5 of the outstanding balance divided by 12 months example.

2022 Fha Qualifying Guidelines Fha Mortgage Source

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan What To Know Nerdwallet

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator

Fha Student Loan Guidelines Fha Lenders

Fha Loan Policy And Student Loan Payments

Current Fha Home Loan Rates Fha Mortgage Rates

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

Fha Loan Policy Changes For Student Loan Debt Calculations

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

Average Student Loan Payment Estimate How Much You Ll Pay

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home